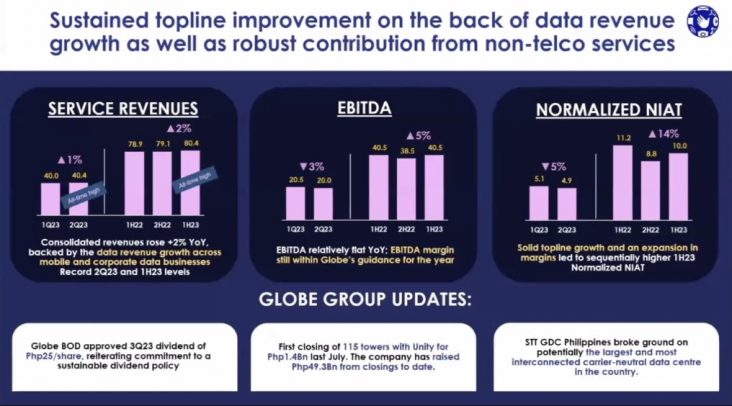

The Globe Group’s consolidated service revenues rose 2% to a record ₱80.4 billion for the first half of 2023 showing stable revenues year-on-year, backed by the data revenue growth across mobile and corporate data businesses. The sustained topline improvement was likewise supported by the robust contribution from its non-telco services, which now account for 3.5% of total gross service revenues. Total data revenues as of the first semester of the year amounted to ₱65.9 billion, increasing its contribution to the topline from 81% last year to 82% this period.

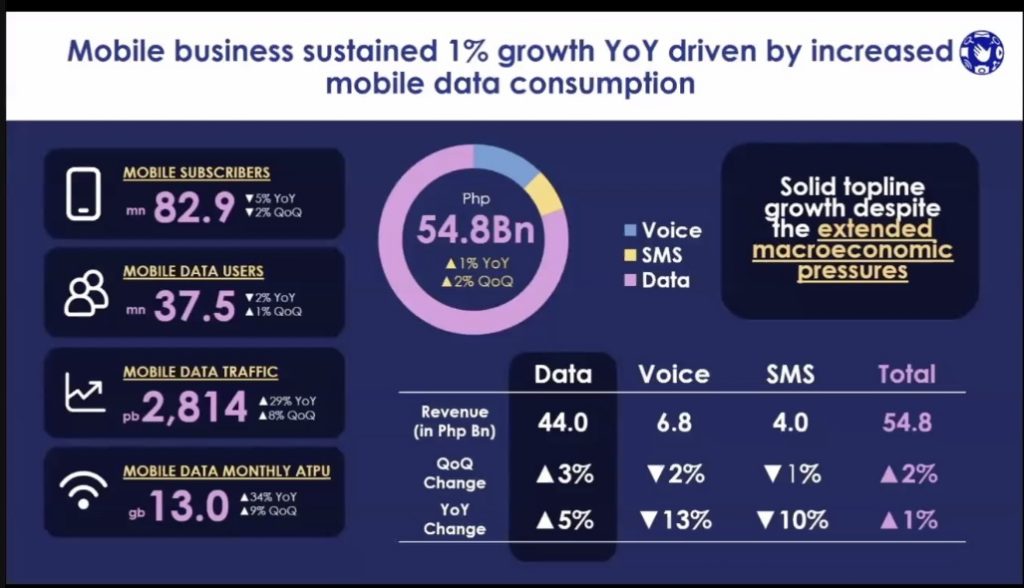

Mobile business revenues as of end-June 2023, stood at ₱54.8 billion or higher by 1% compared to ₱54.0 billion reported a year ago, mostly coming from the company’s prepaid brands. The wireless segment showed growth on the revenue line despite the inflationary pressures not present in the same period last year, as it continues to benefit from the return to pre-pandemic levels of public mobility. On a sequential basis, the growing data habituation of Filipinos resulted in a 2% quarter-on-quarter improvement in revenues. Total mobile revenues comprised 68% of the total consolidated service revenues, with the total mobile customer base ending at 82.9 million for the first six months of the year.

From a product perspective, mobile data revenues posted a record ₱44.0 billion for the six-months period of 2023 or up 5% from the ₱41.8 billion a year ago. Mobile data traffic continues to grow steadily, reaching 2,814 petabytes as of end-June of 2023, higher than the 2,177 petabytes reported in the year earlier. This was mainly fueled by the growing popularity of streaming and user-generated content through social media. Mobile data now accounts for 80% of mobile revenues from 77% last year. On the other hand, traditional mobile voice and SMS revenues ended at ₱6.8 billion and ₱4.0 billion, lower year-on-year by 13% and 10%, respectively.

The Home Broadband business closed the first six months of the year with ₱12.8 billion revenues from ₱13.8 billion reported in the same period last year. The drop in the legacy and fixed wireless products was partly offset by the sustained expansion in postpaid fiber subscribers and revenues, growing 10% and 23%, respectively.

Additionally, total Home Broadband subscribers now stand at 2.2 million or down by 31% versus last year. This decline is in line with the normalization of the fixed wireless base as the market shifts to the more reliable wired connectivity and is expected to stabilize with the end of the sim registration. HPW data traffic likewise declined to only 166 petabytes as of end-June 2023 from 253 petabytes recorded in the similar period of 2022. The decline in FWA revenues and operating metrics have begun to slow down in the second quarter of 2023, suggesting the bottoming out of this trend. The company expects these FWA metrics to continue to decline organically over the next 4 quarters, with FWA revenues eventually dropping to ~₱600 million from the ₱986 million reported in the second quarter of 2023, or approximately 10% decline per quarter. FWA subscribers are likewise expected to normalize in the third quarter, post-expiry of the sim card registration period.

As part of the Company’s thrust to accelerate its fiber business and make fiber-speed internet affordable to all Filipinos, Globe launched the revolutionary offering GFiber Prepaid last June. GFiber Prepaid is designed to reach the mass market segment which remains to be under-served. It aims to democratize access to fiber connectivity, offering a No Lock-Up, Unli Pay-Per-Use promos, and Buy Now, Pay Later options with GCash. With GCash’s Buy Now, Pay Later feature, customers can pay in installments up to a 24 months using the app or pay with a credit line of up to ₱50,000. Customers can acquire a GFiber Prepaid service with a special introductory offer of a one-time fee of ₱1,499, inclusive of installation and seven days of unlimited internet. They can also choose from a selection of unlimited data promos with GFiberSurf299 for seven days, GFiberSurf549 for 15 days, and GFiberSurf999 for 30 days.

Moreover, GFiber Prepaid provides customers with a fully digital experience from application to scheduling of installation and account management. Customers may easily sign up for the service via the GlobeOne app. Also, as part of Globe’s commitment to sustainability and circularity, GFiber Prepaid comes in recyclable and upcyclable packaging, which can be repurposed and used as a laptop stand.

Corporate Data business on the other hand, posted a record ₱9.1 billion revenues during the six-months period of 2023, surpassing last year’s performance by 11%. This was mainly spurred by the strong demand for information and communication technology (ICT) services which grew 36% year-on-year with Globe’s continued support to businesses on their digital transformation journey.

Furthermore, Globe’s shift from telco to techco prompted the organization to expand its vision and place greater emphasis on digital solutions. The company has ventured into digital marketing solutions, venture capital funding startups, virtual healthcare, e-commerce, business outsourcing, adtech, edutech, media, and entertainment, among others. As of the first half of the year, its non-telco revenues soared to ₱2.8 billion from ₱1.9 billion in the same period of 2022. This stellar performance was due to the substantial contributions from ECPay, Asticom, and Adspark.

Meanwhile, Globe’s total operating expenses including subsidy as of end-June of 2023 amounted to ₱39.9 billion, jumping from ₱38.3 billion reported as of end-June of 2022. This was largely attributed to the step up in costs for repairs & maintenance, administrative expenses, services and others as well as depreciation, partly cushioned by lower marketing & subsidy, staff cost, lease and provisions.

Globe Group’s consolidated EBITDA ended at ₱40.5 billion, relatively flat year-on-year, as the 2% topline expansion was offset by the 4% surge in operating expenses (including subsidy). EBITDA margin which dropped from 51% to 50% this period, remains within Globe’s guidance for the year.

Mynt, the Globe Group’s fintech arm, has continued to outperform expectations. Its continued strong performance and steady user base and usage growth has led to an increase in its profitability. The Globe Group’s share in Mynt’s equity earnings amounted to close to ₱1.0 billion already, which amounts to more than 5% of net income before tax.

Total normalized net income for the first half of 2023 came in at ₱10.0 billion, an impressive 14% growth against the normalized income reported in the second half of 2022, which operated in a similar macroeconomic backdrop. Against the same period last year, net income dropped by 27%, mainly due to the increased depreciation expense as well as the 78% decline in total non-operating income, which was due to the one-time net gain of ₱8.5 billion (post-tax) reported last year from the partial sale of Globe’s data center business. Excluding this one-time gain, normalized net income would have been ₱10.0 billion, or down by 11% compared to the previous year.

Accordingly, core net income, which excludes the impact of non-recurring charges, and foreign exchange and mark-to-market charges, closed at ₱9.9 billion for the period or up 22% on a sequential basis. Year-on-year, however, core net income similarly was down by 10%.

Globe’s balance sheet remained healthy and gearing comfortably within bank covenants despite the increase in debt from ₱233.2 billion as of end-June 2022 to ₱250.0 billion this period. Globe’s gross debt to equity is at 1.57x while gross debt to EBITDA is at 2.64x; Net debt to equity ratio is at 1.41x while net debt to EBITDA is 2.38x; and debt service coverage ratio is at 3.96x.

“The Globe Group continues to perform well during the first half of the year, despite facing macroeconomic challenges. We were consistent in delivering revenue growth on our mobile and corporate data businesses. More notable, we outperformed the industry with the upbeat growth trajectory of our digital solutions platforms” Ernest L. Cu, President and CEO of Globe Telecom Inc., said.

“We are confident that Globe will maintain its leadership in mobile going forward. The company is also well-positioned to adapt to the industry’s changing landscape and take first mover advantage with its innovative digital solutions that deliver life-enabling services to Filipinos.” Mr. Cu, added.

For Key Business, Key Portfolio and Sustainability Highlights, visit here: GLO-2Q23-Press-Release