While money doesn’t grow on trees, it can grow when you save and invest wisely.

Knowing how to secure your financial well-being is one of the most important things you’ll ever need in life. That is why, financial planning is crucial for individuals, families, and businesses alike.

Financial planning is a step-by-step approach to help you achieve your financial goals— be it buying a family home, saving for children’s education, having a comfortable retirement, or starting a business. It also prepares you for unforeseen situations and emergencies such as falling ill, losing your job, or having to renovate your house.

Having enough savings, investments, and cash on hand to afford the lifestyle you want for yourself and your family— that is financial freedom, and it is the ultimate goal for many people. Unfortunately, too many people fall far short of achieving this. Well, no one is immune to financial problems. But even without occasional financial emergencies, growing debt, medical issues, and overspending can really tip the scales.

Good thing is, with discipline and careful financial planning, it is still possible to reset your financial journey even at any stage of your life.

Restarting Your Financial Journey

Restarting your financial journey can be an empowering and transformative process. But keep in mind, everyone’s financial journey is unique, and it takes time to achieve financial stability and success. Restarting your financial journey requires discipline and perseverance. Stay committed to your goals and make consistent efforts to improve your financial situation. Below are some steps you can take:

- Analyze your finances: Begin by taking an honest look at your financial situation. Evaluate your income, expenses, assets, and debts to understand where you stand and identify areas that need improvement.

- Set financial goals: Determine your short-term and long-term financial goals. Are you aiming to pay off debt, save for a down payment, start investing, or just really achieve financial independence? Clearly define your goals to give yourself a sense of purpose and direction.

- Create a budget: A budget is a crucial tool for managing your finances effectively. Track your income and make sure your expenses align with your priorities and financial goals. You can create a budget that works perfectly to get you there!

- Increase your income: Consider taking on a side gig, freelancing, or developing new skills that can lead to higher-paying roles. Explore opportunities to boost your income to accelerate your progress toward your financial goals.

- Start saving and investing for the future: Start by setting aside some money for emergencies. Aim to save at least three months’ worth of living expenses. Try also opening a retirement account. Once you have a solid financial foundation, consider investing to grow your wealth over time.

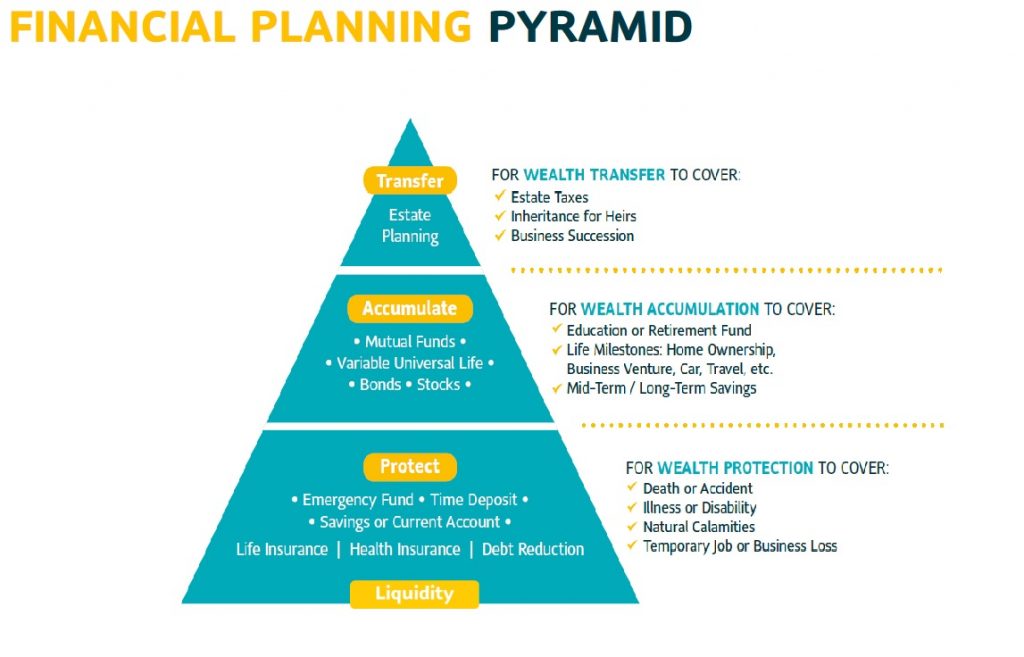

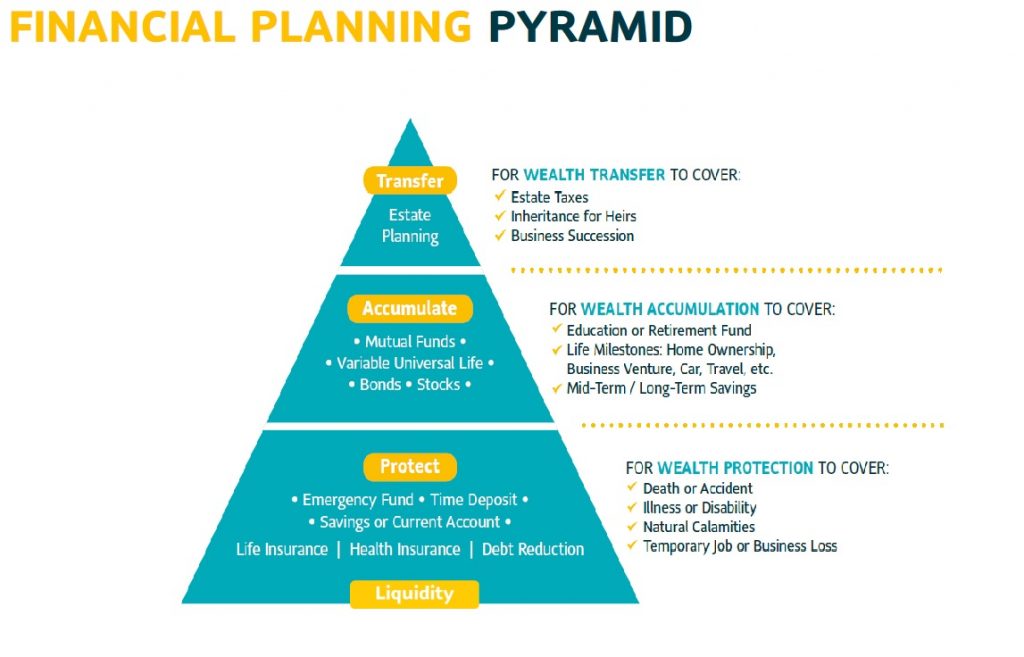

Certainly, financial planning emphasizes the importance of saving and investing. Savings and investments are mutually connected and are both important to consider in your future planning.

It is said that one should save around 10 per cent of one’s income every month and put aside 10 to 15 per cent of income into investments. Through saving money, your money is kept safe, and easy to access should you need it for let say education or travel. By investing early over time, such as mutual funds and bonds, your money grows in value (thanks to the magic of compounding). Savings will usually fetch your minimal gain while investments are funds put into plans that fetch you better gains, at the end of a certain period.

While savings are for the short-term, investments should be on long-term basis as they help you grow your wealth for a brighter future.

Your Partner for a Brighter Future

Maintaining your financial journey is just as important as restarting it in the right place. So, if you’re new to investing, it may be beneficial to consult with a financial advisor to help you make informed investment decisions.

Sun Life has a network of financial advisors who can provide personalized guidance and advice based on your specific financial situation and goals. These advisors can help you develop a comprehensive financial plan, provide investment recommendations, and assist you in making informed decisions about saving and investing. You can also talk to a financial advisor here.

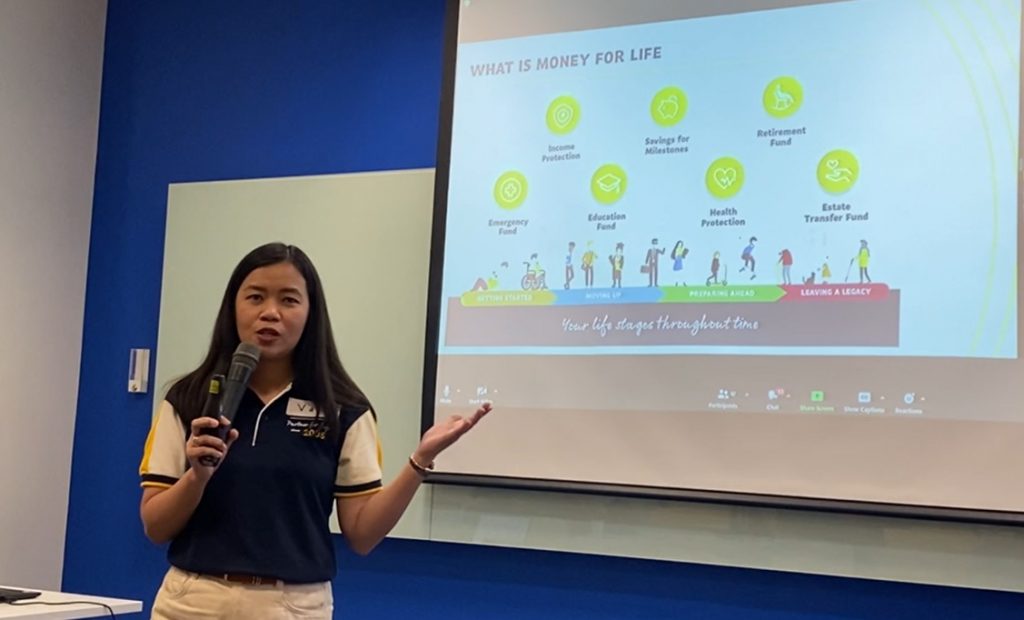

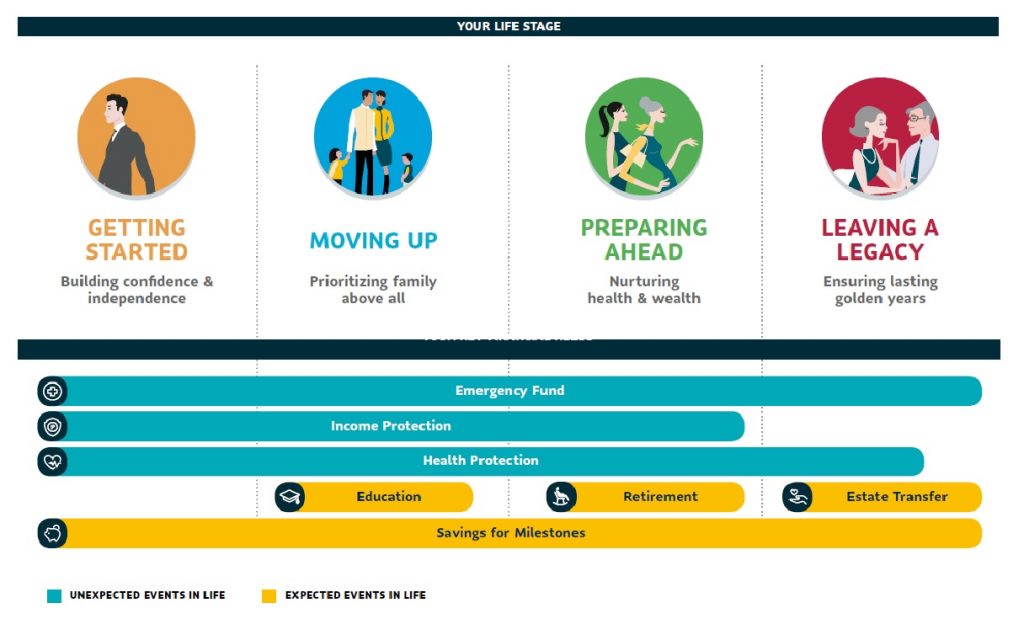

Sun Life provides online tools and resources like the Money for Life that can help you plan, track, and manage your savings and investments.

Sun Life helps you to make informed investment decisions for a lifetime. As a number one insurance company in the country, Sun Life helps clients live healthier lives and achieve lifetime financial security.

Sun Life offers life insurance plans to meet your financial needs for every important stage in your life. From getting started with simple and affordable protection plans, to building funds with investment-linked products to fulfill life goals.

Remember: A financial plan acts as a guide as you go through life’s journey to make informed decisions, optimize your financial well-being, and prepare you towards financial freedom. Embrace the opportunity to regain control, stay focused, adapt as needed, and always make positive financial choices to create a brighter financial future for yourself.

Here’s to generating good results with your financial journey!